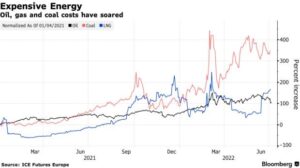

Russia has pocketed $24 billion from selling Funnel energy to China and India in just three months following its invasion of Ukraine, showing how higher worldwide costs are restricting endeavors by the US and Europe to rebuff President Vladimir Putin.

China burned through $18.9 billion on Russian oil, gas, and coal in the three months to the furthest limit of May, practically twofold the sum a year sooner, most recent customs data show. In the meantime, India dished out $5.1 billion in a similar period, in excess of multiple times the worth of a year prior. That is an extra $13 billion in revenue from both countries compared to the very few months in 2021.

Table of Contents

Funding Boost

China and India’s spending on Russian energy imports this year has doubled

Source: China Customs; India trade ministry

Note: Combined China and India imports of Russian oil, gas, and coal in US dollars

The higher spending is helping compensate for decreased buys from the US and a few different countries that have stopped or eased back buying to rebuff Russia for the conflict. The boycotts have sent costs for elective supplies taking off and prodded devastating expansion that takes steps to send significant economies into a downturn.

“China is as of now buying essentially all that Russia can trade through pipelines and Pacific ports,” said Lauri Myllyvirta, a lead expert at the Center for Research on Energy and Clean Air, who has been following Russian energy streams since the conflict broke out. “India has been the primary purchaser of the cargoes out of the Atlantic that Europe doesn’t need any longer.”

That binge is probably not going to end at any point in the near future, with energy costs a lot higher than they were as of now last year, in any event, representing the precarious limits to worldwide benchmarks Russia is proposing to captivate buyers. On a volume premise, China’s imports proceeded with a sluggish increase in June, while India might have a motivating force to help buy considerably further before long as a European Union prohibition on Russian oil produces results, Myllyvirta said.

China and India actually trail Europe as a coalition regarding general deals this year, as per Myllyvirta’s examination. Europe’s buys will keep on contracting, however, as import prohibitions on coal and oil happen and as Russia

cuts off gas supplies to some European buyers.

Russia has well-established trade and vital associations with China and India, and alongside offering steep cost limits likewise tolerating installments in nearby cash to assist with keeping trade streams to the countries solid this year.

China Buys

China’s spending on Russian energy has risen for the current year on higher costs

Source: China Customs

Note: Covers the months of March, April, and May

China is the world’s greatest energy merchant and has devoted pipelines for Siberian oil and gas. Indeed, even as its energy utilization was checked over the primary portion of 2022 – – mostly because of Covid-19 lockdowns – – it spent undeniably more on Russian energy because of higher costs and little expansions in volumes.

India’s expansion in spending after the conflict has been undeniably more sensational, as it doesn’t share a landline with Russia and its ports are regularly too far away for cost-effective transportation. The nation burned through $8.8 billion on oil and coal imports from Feb. 24 to June 30, a bigger number than it was given out for all Russian merchandise for the whole year in 2021, as per a trade ministry official, who mentioned obscurity as the data isn’t public. India’s trade ministry representative didn’t remark. In addition to big jumps in oil and coal, India also imported three cargoes of Russian liquefied natural gas since the war began, compared to one in the same period last year, according to Bloomberg ship-tracking data.